Recover More. Stress Less – that’s the goal of every business leader navigating overdue invoices and cash flow slowdowns.

Managing cash flow effectively means acting quickly. The longer unpaid invoices sit, the more they disrupt business operations. Every business owner knows that overdue payments can be a significant obstacle to growth. The more time spent on following up on overdue invoices, the less time you have to focus on scaling your operations, serving customers, and driving business success.

This is where expert recovery solutions come in, offering a way to recover outstanding payments efficiently, without disrupting your daily operations.

Why Debt Recovery Matters

Unpaid invoices don’t just slow down cash flow – they can delay investments, disrupt operations, and put added pressure on customer relationships. When payments are late, businesses may struggle to reinvest in growth, maintain financial stability, and ensure smooth customer interactions.

Outsourcing debt collection to professionals allows your business to focus on its core operations, freeing up valuable time that would otherwise be spent managing past-due accounts. A professional recovery team helps maintain brand credibility by ensuring a structured and fair approach to collections while securing the funds necessary for sustained success.

If late payments are becoming the norm or your internal team is stretched thin, it may be time to bring in the experts. Forbes highlights key indicators that signal when hiring a collections professional is the right move. Learn more in this Forbes article.

The Power of Expert Recovery

Expert recovery services go beyond routine follow-ups on overdue accounts. Professionals develop customized strategies that align with your business values, ensuring a respectful and professional approach that preserves customer relationships.

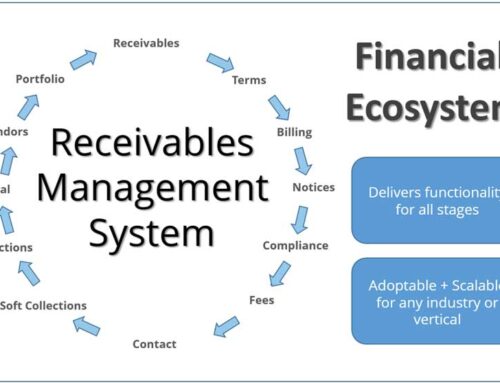

A professional collections team leverages advanced tools and proven techniques to streamline the recovery process. They know how to maximize recovery efforts while ensuring compliance with industry regulations – protecting businesses from potential legal or reputational risks.Additionally, expert recovery teams understand industry nuances and tailor its approach accordingly. Forbes emphasizes the importance of having a well-structured debt collection strategy, noting that clear communication and early expectation setting can significantly improve recovery outcomes. Learn more in this Forbes article on successful debt collection strategies.

Why Outsourcing Collections Makes Sense

While it might seem cost-effective to handle collections in-house, it often drains resources and impacts overall productivity. Handling overdue invoices internally pulls employees away from their primary responsibilities, reducing efficiency across all departments.

By outsourcing collections to professionals, businesses can improve recovery rates while ensuring compliance with necessary regulations. This allows internal teams to stay focused on growth and customer service, rather than chasing overdue payments.

Partnering with a collections expert is a strategic move that can enhance cash flow, reduces administrative burdens, and prevents operational disruptions. It also helps reshape the perception of debt recovery.

As the Chartered Institute of Credit Management (CICM) highlights, professional debt recovery services can create a structured and fair approach that benefits both creditors and debtors – helping businesses maintain stronger, long-term relationships with customers.

Strengthen Your Business with Expert Recovery Solutions

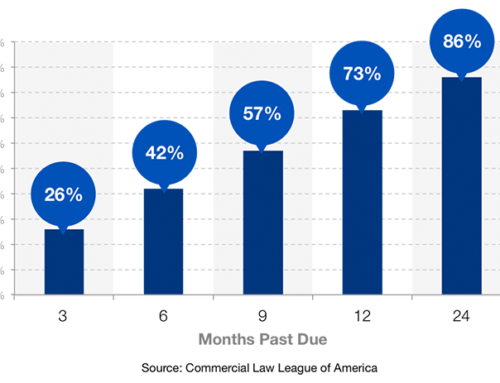

When it comes to maximizing your cash flow and reducing stress, expert debt recovery services are a valuable asset for businesses of all sizes. The longer overdue payments remain unsettled, the greater the impact on financial stability.

By partnering with a professional recovery service, businesses can recover outstanding debts efficiently while maintaining strong customer relationships.

For further insights, Forbes offers guidance on essential debt collection strategies and key indicators for when to seek professional support. Additionally, CICM highlights how professional debt recovery can be mutually beneficial, helping businesses secure payments while maintaining professional relationships with customers. Leveraging these expert insights can help your business take a proactive approach toward financial stability.