Explore the Possibilities: How Insight Financial Can Help Your Business Simplify Collections and Accelerate Cash Flow

In today’s competitive business landscape, managing receivables and collections efficiently is crucial to your success. Struggling with overdue invoices? Our debt collection services help businesses get paid faster, recover more, and maintain strong customer relationships. At Insight Financial, we offer tailored strategies to simplify collections, accelerate cash flow, and preserve the relationships that mater most.

This blog introduces the core benefits of our services, and over the next few weeks, we’ll be shedding light on how we can help you Get Paid. Stress Less. Build Trust. Stay tuned for more insights!

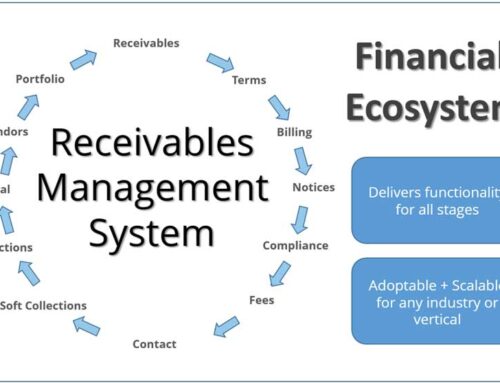

Simplify Collections, Maximize Efficiency

Collections can often feel like a tedious and stressful process. That’s why we focus on simplifying it for you. Insight Financial’s expert team understands the nuances of debt recovery, and we tailor our approach to fit your specific needs. By optimizing your collection strategy, we free up your time and resources, enabling you to focus on what truly matters—growing your business.

This is just one of the ways we help you recover what’s owed—stay tuned to learn more in our next post!

Accelerate Cash Flow, Fuel Business Growth

When cash flow is delayed, it can create a ripple effect that disrupts operations and hinders growth. With our accelerated cash flow solutions, Insight Financial ensures that overdue accounts are resolved quickly and efficiently. This not only helps you maintain healthy financials but also gives you the resources you need to invest in opportunities that will fuel future growth.

In an upcoming post, we’ll show you exactly how we can help you accelerate cash flow and keep your business on track.

Preserve Client Relationships, Maintain Trust

One of the biggest concerns businesses have when dealing with overdue accounts is the impact on client relationships. At Insight Financial, we prioritize preserving the trust you’ve built with your clients. Our approach is designed to handle collections with the utmost professionalism and respect, ensuring that your reputation stays intact while you recover what’s owed to you.

Stay tuned for a deeper look into how we help you recover more while ensuring client trust is maintained in our next post.

The Insight Financial Advantage: Tailored Strategies for Success

What sets Insight Financial apart is our customized approach to debt recovery. We take the time to understand your unique business processes and challenges, crafting solutions that align with your goals. Whether you’re a small business or a large enterprise, we provide the tools, resources, and expertise you need to achieve a smoother collections process and better cash flow.

Unlock Your Business’s Potential

At Insight Financial, we believe in helping businesses Get Paid, Stress Less, and Build Trust. Our mission is to provide world-class service with a focus on communication, transparency, and results. Explore the possibilities today and discover how our proven debt collection services can help transform your collections process, improve your cash flow, and preserve your customer relationships.

Ready to unlock your business’s potential? Contact us today to learn more.