Get Paid Faster, Grow Stronger

Cash flow is critical for business success, but slow payments can get in the way of growth. At Insight Financial, we help businesses like yours get paid faster, allowing you to focus on what matters most – growing your business. Our expert receivable management and debt collection solutions are designed to deliver results, efficiently recovering outstanding balances. At Insight Financial, we understand that reliable cash flow is essential for every business to thrive.

The Impact of Delayed Payments

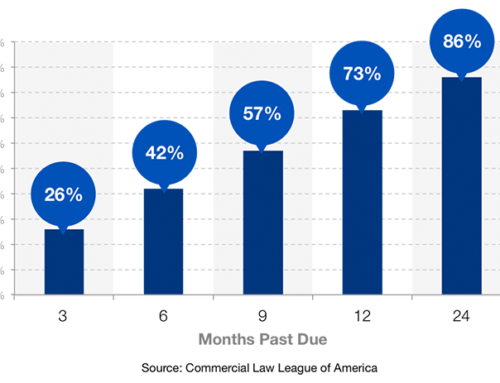

Late payments don’t just disrupt cash flow—they can stall business growth, delay investments, and create unnecessary stress for your team. Many small businesses struggle with delayed customer payments, leading to wasted resources and stalled expansion efforts. According to Forbes, navigating late payments is a critical challenge for businesses of all sizes, requiring proactive strategies to maintain financial security and operational stability. When businesses devote too much time to chasing overdue invoices, they lose valuable growth opportunities. That’s where Insight Financial steps in—helping you regain control of your cash flow so you can focus on what truly matters: building your business.

How Insight Financial Helps You Recover More

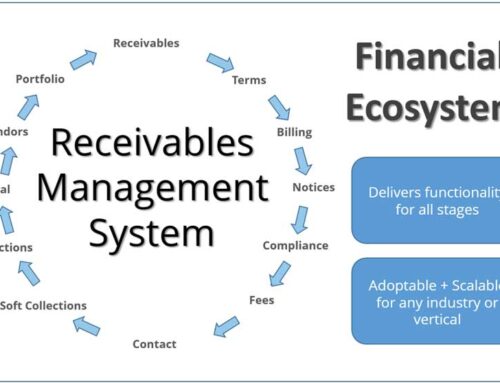

We offer tailored receivable management and debt collection services that aim to accelerate the recovery process, reduce the burden on your team, and improve cash flow—without compromising the relationships you’ve built with your customers. Our approach combines strategic outreach, transparent communication, and industry expertise to ensure that you can focus on growing your business while we handle the collections process.

- Streamlined Receivable Management: We work to optimize your accounts receivable process, preventing delays and keeping collections on track from the start.

- Professional Debt Recovery: Our team handles past-due accounts with care, urgency, and professionalism to improve your recovery rates.

- Clear Communication Every Step of the Way: Stay informed with our easy-to-use client portal that keeps you up-to-date on the status of your collections.

The Possibility of Stronger Cash Flow

Imagine a business where cash flows more smoothly, overdue invoices don’t hold up your progress, and you have the confidence to reinvest in growth initiatives. This is the possibility we help create for businesses like yours. Whether you’re a small business or a larger enterprise, our tailored solutions ensure you can keep your cash flow on track and your focus on growth.

Stay Tuned for More Insights

This blog is part of our Explore the Possibilities series, where we breakdown key strategies that help businesses thrive in a competitive market. In our next post, we’ll explore how our tailored collection strategies not only help you recover more but also preserve the valuable relationships you’ve worked hard to build.

Ready to get paid faster and grow stronger?

Contact us today to learn how we can help transform your cash flow and drive business growth.

#ExploreThePossibilities #DebtCollection #CashFlow #BusinessGrowth #DebtRecovery #ReceivableManagement #BusinessSuccess #FinancialGrowth #ClientSuccess