Protecting Relationships While Recovering Revenue

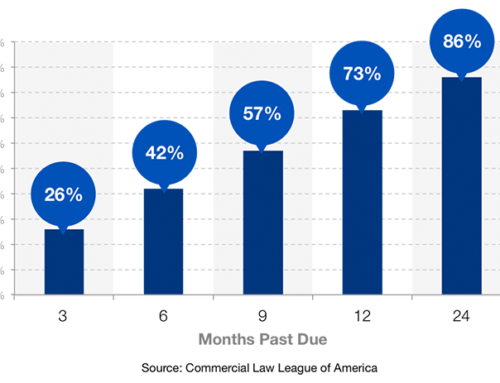

In industries like construction, restoration, and professional services, collecting unpaid invoices can be one of the most frustrating and time-consuming tasks. When reminders and goodwill haven’t worked, turning to collections marks a clear decision: it’s time to be paid – and to be taken seriously.

At Insight Financial, we understand that our clients are seeking a real solution. That’s why our approach is built around delivering measurable results through a professional, complaint, and reputation-conscious process.

Escalating Debt Collection Without Compromising Integrity

Getting paid shouldn’t come at the cost of your reputation. Insight Financial was founded to offer businesses a better option – one that applies strategic pressure, respects legal and ethical boundaries, and protects the customer relationship you’ve worked hard to build. We operate as a true extension of your brand, never a liability to it. Our team is trained in the best practices recommended by leading industry authorities, and we approach every account with precision, professionalism, and respect.

InsideARM, a trusted source in the accounts receivable management industry, reinforces this approach. In their article, “4 Vendor Management Best Practices for Collection Agencies,” they note that collections are most effective when expectations between businesses and agencies are clearly defined, and when collection partners act as an extension of your brand , not a liability to it.

Our collection approach is disciplined and results-driven, built on years of industry expertise and the principles of fairness and compliance. We work with you to recover what’s owed, without compromising the standards that set your business apart.

Professionalism That Drives Results

Many of our clients come to us after delivering on their promises—completing work, honoring contracts, and fulfilling obligations—only to be left chasing unpaid invoices. When it’s time to escalate, they’re not just looking for collections; they’re looking for a professional partner who can act with strength, strategy, and care.

Our collection team receives ongoing training in federal and state collection laws, including the Fair Debt Collection Practices Act (FDCPA), and follows all guidance set forth by the Consumer Financial Protection Bureau (CFPB). More than just regulatory compliance, we emphasize tone, consistency, and respect in every interaction.

According to a 2025 InsideARM article on digital debt collection trends, agencies that combine strict compliance with a professional, firm presence achieve better results and reduce escalated complaints (InsideARM:Digital Debt Collection Report, 2025).

Our team strikes the perfect balance between professionalism and persistence—achieving results without sacrificing integrity.

Compliance and Ethics You Can Trust

We’re serious about recovering what’s owed while maximizing results – but never at the expense of professionalism. A strong, ethical approach to collections preserves the reputation you’ve worked hard to build, even when past due accounts need to be escalated.

That’s why our team maintains Professional Collection Specialist (PCS) certification through ACA International, the leading association for credit and collection professionals. This ensures we are trained in:

- Effective and professional communication

- Regulatory compliance with FDCPA and CFPB guidelines

- Ethical practices that focus on resolution, not escalation

With this foundation, we handle your accounts with the integrity they deserves — delivering results while upholding your reputation and ensuring compliance.

Results Without Regret

Escalating an account to collections doesn’t have to damage relationships. When handled with professionalism and integrity, it can actually reinforce your company’s commitment to accountability and timely payment.

At Insight Financial, many of our clients continue to place new accounts with us – not just because we recover what’s owed, but because we do it in a way that reflects their standards and values. Our approach proves that it’s possible to pursue past-due balances without compromising future opportunities.

One client put it this way:

“Insight Financial listened to our concerns and are extremely professional… We all work hard to uphold a fine reputation, and we have no doubt that the team at Insight represents us well on each call.”— Julie, Business Director

We’ve built our system to support your business goals, uphold your reputation, and send a clear message: professionalism includes paying on time. When collections are approached the right way recovery isn’t a breakdown – it’s a breakthrough.

Explore the possibilities of collections done right.