The Power of Insight: Tailored Solutions. Proven Results.

In the world of accounts receivable and debt recovery, one-size-fits-all approaches simply don’t work. Businesses operate in different industries, serve unique customers, and face distinct challenges when it comes to recovering what they are owed. At Insight Financial, we believe that knowledge drives results—and that’s why we take the time to understand the specific needs of every client we serve.

Why Tailored Solutions Matter

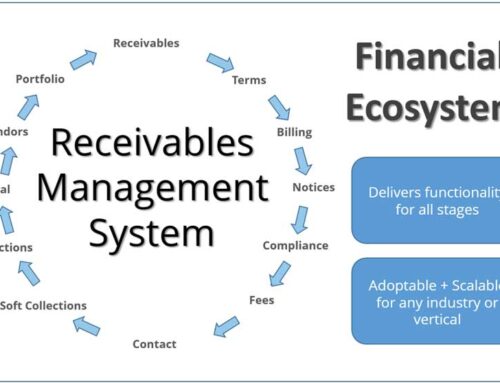

A business in the construction industry has vastly different collection challenges than a professional service provider. Emergency restoration companies may struggle with slow insurance payments, while B2B service providers might face non-payment due to cash flow constraints from their customers. Each scenario requires a nuanced approach—one that balances persistence with professionalism, and strategy with compliance.

By tailoring our debt recovery strategies, we ensure that every client benefits from a method that aligns with their industry’s best practices while maximizing their recovery rates. We analyze key factors such as:

- Industry-specific collection challenges

- Customer communication preferences

- Legal and compliance requirements

- The most effective negotiation strategies for each debtor profile

Knowledge That Drives Results

At Insight Financial, our expertise goes beyond standard collection practices. We leverage data-driven insights, industry trends, and years of experience to create customized strategies that work. This means:

- Higher recovery rates with less friction

- Stronger client-debtor relationships

- Reduced risk of legal complications

We also stay ahead of industry changes, ensuring that our clients benefit from the most effective and compliant collection methods available. By combining insight with action, we provide a seamless experience that turns past-due accounts into recovered revenue.

Transforming Your Business Through Better Recovery

Outstanding receivables can slow business growth, impact cash flow, and create unnecessary stress. But with the right partner, businesses can optimize their recovery processes, improve their bottom line, and focus on what they do best—serving their customers.

At Insight Financial, we don’t just collect debts. We provide a strategic, results-driven approach that helps businesses maintain financial health and long-term stability. Let us show you how the power of insight can transform your recovery strategy.

Ready to optimize your accounts receivable? Contact us today and experience the power of Insight through tailored solutions and proven results.